The first set of updates for FiP felt raw and was in a ‘figuring things out’ mode. As I move forward and go further down the creator rabbit hole, the updates I share will still be about “figuring things out,” but they will now be in a particular direction.

I also received feedback about how I interchangeably use ‘I’ and ‘We’ in this newsletter. It’s something that I have given some thought to, so to explain it quickly; I will use the term ‘I’ when it relates to a personal perspective or something outside of the work. So, for example, with Adam Pearce and I working together on Wildfire, I will use ‘we’ to reflect the position of the entity/collective.

Now for this week’s updates.

Things I Have Done

I.

Enriching Subscriber Lists

One proof of concept that we have been working on is helping writers learn more about their subscribers. Below is an outline of the problem and our progress.

Target audience: Newsletter writers and solopreneurs

Desired action: Identify which type of subscribers have a higher propensity to convert from free to paid

So that: Messaging and outreach campaigns can be adjusted to target/convert these people.

Desired outcome: Increase the number of qualified leads for both free and paid subscriptions

Progress - We didn’t have much initial luck with the audience matching from email addresses to public profiles. We did find one service that helps identify names associated with email addresses, allowing us to find other corresponding general information. We are currently focused on populating subscriber lists with the following attributes.

Name

Location

Occupation

Company

If this baseline data proves valuable, we will investigate things like lookalike audiences and prospecting people who tend to purchase subscriptions like this.

—

II.

Launched Twitter Segments

Twitter Segments came from the enriched subscriber list project. One of the data sources we were using to enrich profiles was Twitter. The process is relatively automated, so we decided to make it available to purchase. To our surprise, we have been making sales from it since launching last week. This was personally a significant milestone in the journey for me; as I had said, if I hadn’t made any revenue by June, then I would start reevaluating if this was still right for me.

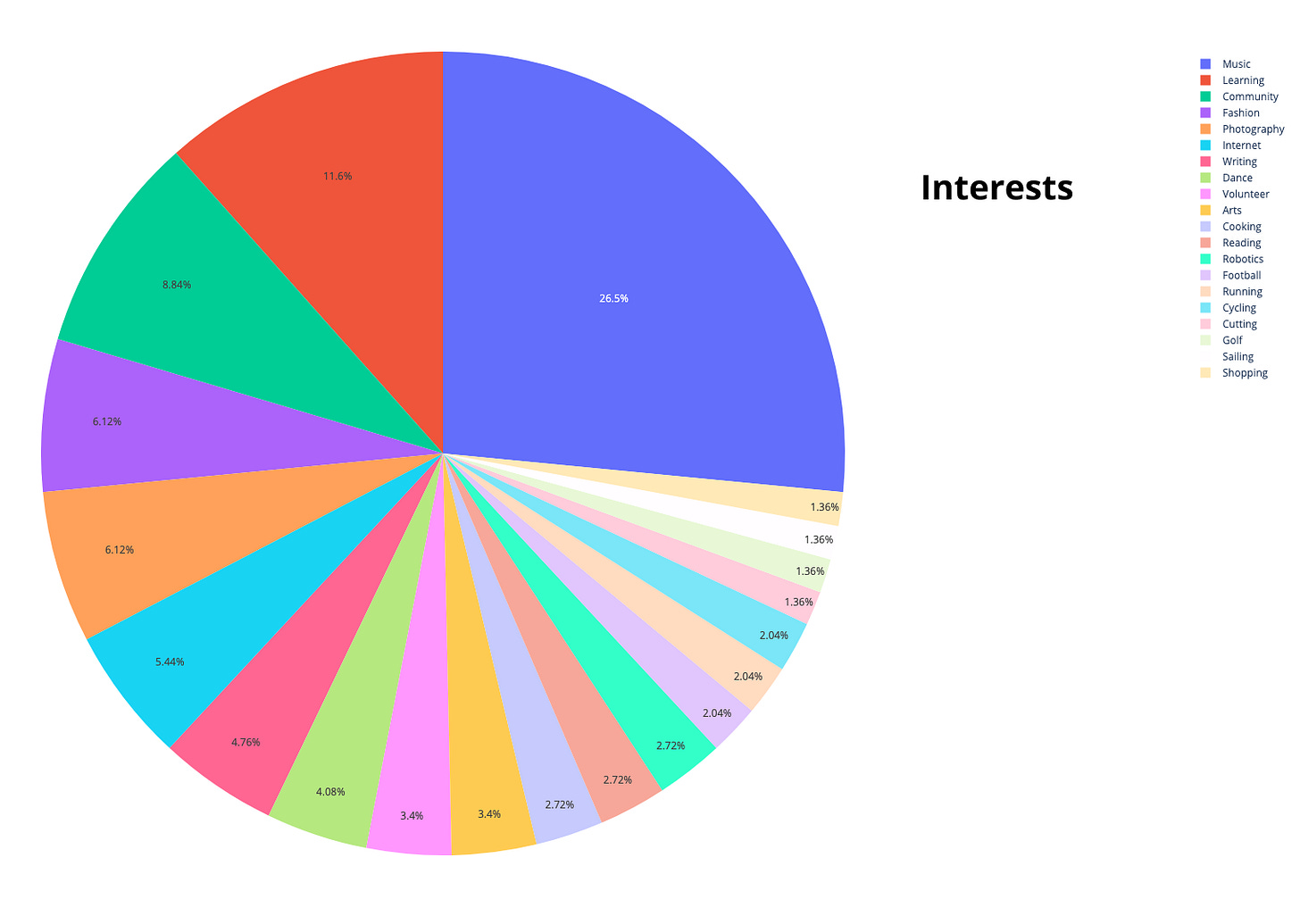

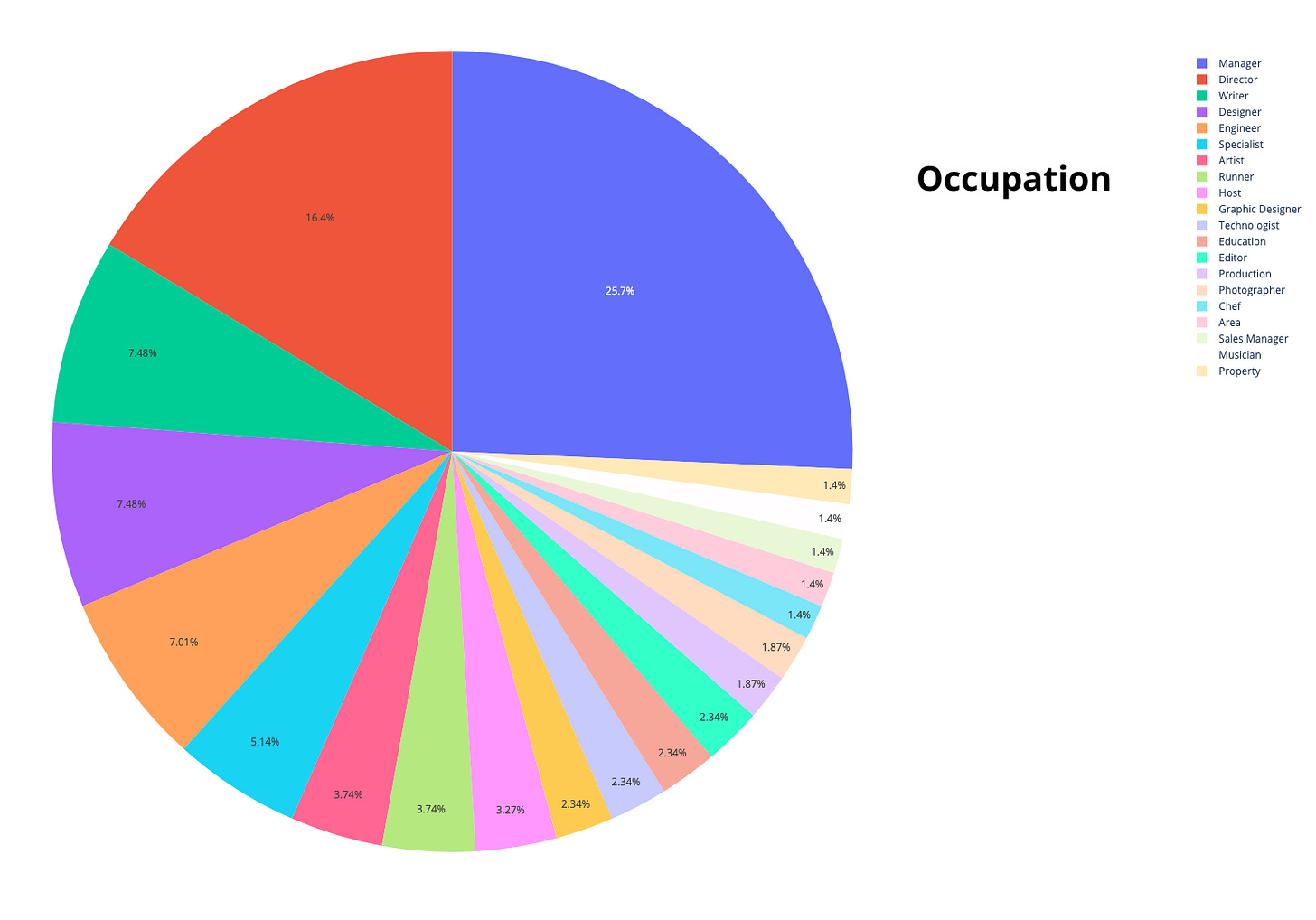

Initially, it was just a CSV export of your Twitter audience, but we have since started to add segments and audience profiling based on feedback. Below is an overview of my audience of 1,600+ Twitter followers. Each chart also comes with a complete list of the users that match those attributes.

—

III.

Kicked off Sweet Kakes Fuddle’s

The discord community we created started to go quiet, so I followed up with members directly to understand why.

I learned that people are already in many communities, but the live catch-ups and brainstorming brought them the most value. We have since kicked off a weekly founders huddle (Fuddle) with this. Every Monday, we get on a call to share what we are working on for the week, trying to achieve this month, and a challenge we are currently facing.

Below you catch this week’s call where we chatted about

Generative AI

YouTube Analytics

Raising pre-seeds

Rap music

Business models

Take rates

If you are a founder building for the creator/ownership economy and want to join our community, please book a chat with me here.

Learnings

I.

Being efficient vs. effective

I haven’t quite got a handle on this one yet. I am constantly working on something as a type-A, but I frequently need to stop and ask if I am ‘good’ busy or ‘bad’ busy. One question that helps me with this is asking myself ‘What is the highest leverage action I can take next?”

—

II.

Actionable insight > insights

The last few weeks have taught me that creators need help making sense of the provided data. SaaS Product Managers are typically trained in how to extract and take action on insights from product data. Creators are not. It might be enough in the SaaS world to provide insights that empower product teams to develop solutions. However, insights for creators should be accompanied by the solution for it.

A Question For You

For startups focused on providing support tooling to creators, what types of business models could be considered outside of revenue share and subscriptions?

Food for thought: The purchasing power of a Creator for tools and services will be significantly lower than that of Enterprise size companies.

With this, how else would you begin to think of this market?

Misc

This section essentially abuses the structure I tried to commit to above.

Things I am asking myself

Should I pivot my existing personal channels (Twitter/Substack) to share content that appeals to my startup target audiences, or should I create new ones on new platforms (TikTok, YouTube)

What mechanism is most effective for making early users co-owners of what you are building?

Equity pools or Tokens?

What business models should I be considering?

Searching for

Creators who have 10+ engagements with partners/advertisers in a month

Cool links and resources

Similarweb - Great site for stats about competitors’ traffic and traffic sources

Virtual Humans - Could we see human influencers replaced by virtual ones?

Pitch - I reviewed a pitch deck that was using pitch.com felt easy to follow, and I am considering using it for our pitch deck. I’m open to other suggestions if you have them?

Graphtreon - List of top paid earners on Patreon

Report on creator burnout - note it has a relatively small sample size of 150 respondents

Surviving the creator economy winter - an excellent piece on what startups who are building for creators should be considering

2022 Creator report by Linktree

Despite popular belief, the creator economy has expanded well beyond sponsored Instagram posts:

70% of creators earn less than 10% of total income from brand partnerships

Working with brands is neither a reliable nor a consistent stream of revenue for most creators

Nearly 70% of creators have not completed any brand partnerships on their social channels

53% of creators earn under $100 from a single brand collaboration

Creators are leaving money on the table with a significant opportunity to monetize:

59% of beginner* creators have not monetized yet

Just 6% of beginner* creators have earned over $10k USD

12% of full-time creators make over $50k USD